Being aware of the Retirement Earnings Test (RET) is critical should you opt for early Social Security benefits before reaching full retirement age (FRA). By not paying attention to the rules, you could potentially take Social Security at a heavily reduced amount and receive none of the benefits. It’s not uncommon for individuals to claim Social Security early, only to find themselves returning to work either part-time or full-time due to boredom in retirement.

Retirement Earnings Test Based on Earned Income

RET is based on earned income. Earned income qualifies as wages from an employer and does NOT include investment earnings, retirement withdrawals, government benefits, interest or capital gains.

Earnings Test and Working

Should you claim Social Security before reaching your FRA and surpass the income threshold, there’s a chance you might not receive any benefits at all, and in certain cases, you may never recover all the benefits that the SSA withheld.

If you are below your FRA, there is a $1 reduction for every $2 of earned income above $22,320. In the year a person is reaching their FRA, there is a $1 reduction for every $3 earned income above $59,520.

There is no retirement earnings test once you reach full retirement age (FRA). There is no ceiling on the amount of earned income you can make and no reduction in benefits if receiving Social Security at FRA or thereafter.

An easy rule: if you are working and earning above $22,000, delay taking Social Security.

What Happens to the Lost Benefits? Do You Get Them Back?

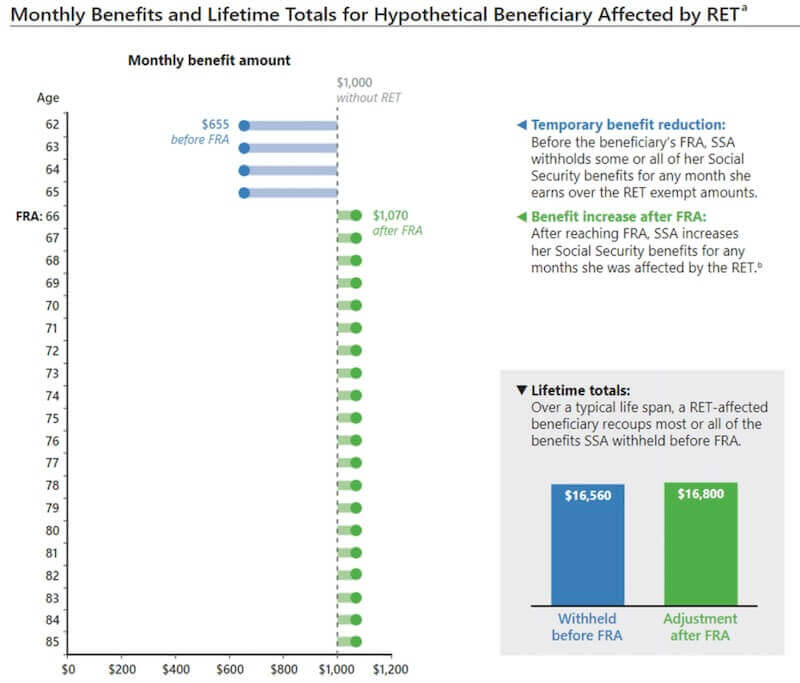

You will not get all your forfeited benefits back in a lump sum at full retirement age. Social Security will increase your benefits for the remainder of your life when you reach FRA. Benefits withheld while you continue to work are not lost; they are added to your monthly benefit once you reach FRA.

If you were to take Social Security at age 62, you would receive around a 30% reduction in your benefits.

Let’s say you forfeited 1 year’s worth of benefits – Social Security would increase your monthly benefit at your FRA. Your FRA amount would now be reduced by only 25% instead of the original 30% reduction. Ultimately, you would receive some of that money back.

The illustration below shows how the RET will reduce the initial benefit during working years and then increase the benefit amount after FRA.

Be Careful of Receiving More Benefits Than You are Entitled to

If you choose to take your benefits early, be careful that the Social Security Administration (SSA) is not paying more than you are entitled to. SSA will not immediately recognize that you are working and above the earned income limit. It’s advisable to contact the SSA and provide an income estimate to avoid receiving more benefits than you’re entitled to. Eventually, SSA will request the overpayment be given back.

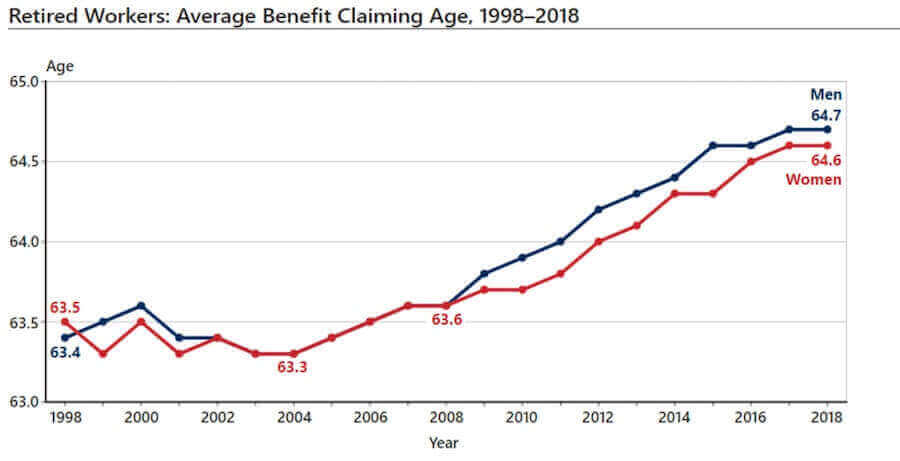

Average Benefit Claiming Age of 64

More people are taking Social Security before their full retirement age than ever before. Make sure you know the rules before making the decision to start your benefits.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Securities and advisory services offered through Osaic Wealth, Inc., member FINRA, SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Representatives may not be registered to provide securities and advisory services in all states. Branch address: 10701 Parkridge Blvd, Ste 130, Reston, VA 20191. Branch phone: 571-543-2783.