When most people think of financial planning and planning for the future, they think about investing, their Thrift Savings Plan, and their retirement income. One side of planning for the future that many people overlook is planning for all the what-if scenarios of life.

One of these what-if scenarios that is often the most problematic for people is what to do if the primary breadwinner (most often the FERS employee) dies before they retire. In this situation, the spouse is often left with high expenses and low income.

This is a problem area for many federal employees because:

- Before retirement, many couples still have a mortgage, auto loans, and other commitments which keeps their expenses relatively high.

- The survivor annuity that the spouse may be eligible for will not come close to replacing the lost salary.

- The spouse may be eligible for a Social Security survival benefit but the earliest they’d be able to start this benefit is at 60 and it will be a reduced benefit if they choose to start it before their FRA (full retirement age).

- The spouse may not be able to access the TSP without a penalty before they reach certain ages (typically 59 and ½).

All of these reasons won’t apply to everyone but you should think through the ramifications for your spouse should he or she be in this situation.

Let’s go through an example to see what this might look like and some possible solutions.

Example

Let’s say that a couple is both 55 years old and the federal employee spouse passes away. Up to this point, the surviving spouse had not worked much because he/she had been a stay at home parent for the past 30 years.

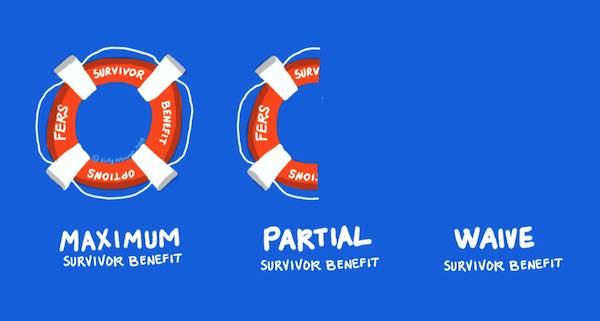

The surviving spouse would be eligible for a survivor annuity because her spouse had been a federal employee for at least 10 years. However, this survivor annuity is only going to be 50% of what the federal employee’s pension would have been if he retired on the date of death. This means that the survivor annuity will probably only replace 10%-15% of the lost salary.

The couple still has a mortgage and has 5 years left to go on it.

The surviving spouse won’t have much of a Social Security benefit on her own record but would be eligible for a survivor benefit based on the work record of the deceased. The problem is that the earliest she could start the survivor benefits is age 60 and it would be reduced if she chose to start it before age 67 (her full retirement age).

Solutions

One solution that may work for some couples is just to plan on the surviving spouse getting a job to make ends meet until full survivor benefits kick in at 67. Another option may be to downsize or otherwise reduce expenses. This may or may not be a viable option for your situation.

Another option is to use life insurance to help fill the gap. Life insurance can be a great tool to help pay off a mortgage (which would lower expenses) or simply pay for living expenses if the main breadwinner were to pass away. If this solution makes sense for you, you will want to do your homework to figure out how much coverage would allow your spouse to be okay and maintain their standard of living.

There may be other options as well depending on your situation and your spouse’s desires.

Conclusion

This situation that I just described may or may not apply to you and your spouse. The most important thing is that you take the time to think through your situation to know how to best plan for the future no matter what happens. At least for me, life is an incredible experience and is often much less stressful when I know that my family and I are going to be taken care of no matter what happens.