This is a multi-part series on tips, tricks, and tactics for managing your TSP in uncertain times.

In follow-up to an article on creating income from your Thrift Savings Plan at retirement (Men and Money Don’t Come With Instructions), there’s a way to add additional power to the split income strategy.

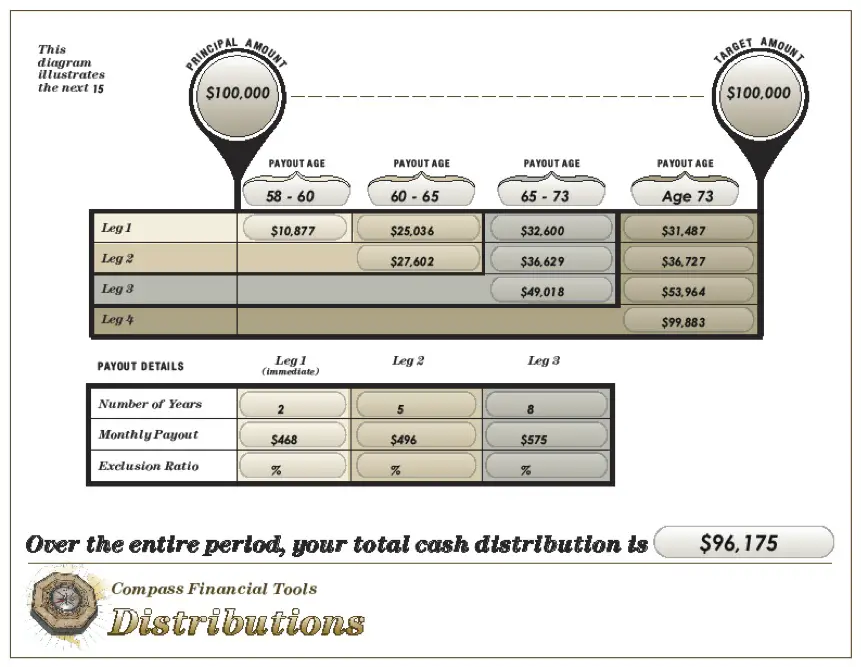

To summarize from the Men and Money article, the split income strategy is built by diversifying your assets not only by asset allocation but also over time. At retirement, since you do not need access to your entire TSP account balance immediately upon retirement (knowing you want it to last over your lifetime), the account balance is divided into segments based on when you plan to use them (i.e., immediately, 5 years, 10 years, or 15 years down the road). This provides the opportunity to take advantage of higher returns over time while utilizing guarantees.

On its own, this strategy provides sustainable income over a retiree’s lifetime.

What if a portion of the final leg could be tax free 15 years down the road when you are ready to use it for income? With a little forethought at implementation, the strategy becomes even more powerful.

Using the illustration above, all or a portion of the last “leg” (the portion set aside to earn returns for 15 years prior to taking earnings) could be converted to a Roth IRA. This would cause a tax liability at the conversion (your taxable income would increase by $31,487), but all of the growth from the original $31,487 to the projected $99,883 could be tax free! That’s right, the income available in fifteen years would all be tax free, AND anything left in the account at your death would pass income tax free to your heirs.

2010 is a particularly good year to take advantage of this strategy, because the limitations around converting to a Roth IRA were eliminated beginning January 1, 2010. When you add in the fact that the Bush tax cuts are still in effect until the end of December, there may never be a better time to implement this strategy.

If you are retired and still have funds in the TSP or you are 59½ and still working, this winning combination may be right for you.